Archive

Capitalist Systems and Income Inequality

Similar levels of income inequality may coexist with completely different distributions of capital and labor incomes. This column introduces a new measure of compositional inequality, allowing the authors to distinguish between different capitalist societies. The analysis suggests that Latin America and India are rigid ‘class-based’ societies, whereas in most of Western European and North American economies (as well as in Japan and China), the split between capitalists and workers is less sharp and inequality is moderate or low. Nordic countries are ‘class-based’ yet fairly equal. Taiwan and Slovakia are closest to classless and low inequality societies.

Similar levels of income inequality may be characterised by completely different distributions of capital and labour. People who belonged to the highest income decile in the US before WWII received mainly capital incomes, whereas in 2010 people in the highest decile earned both high labour and capital incomes (Piketty 2014). Yet the difference in their total income shares was small.

Different distributions of capital and labour describe different economic systems. Two polar systems are particularly relevant. In classical capitalism – explicit in the writings of Ricardo (1994 [1817]) and Marx (1992 [1867], 1993 [1885]) ¬– a group of people receives incomes entirely from ownership of assets while another group’s income derives entirely from labour. The first group (capitalists) is generally small and rich; the latter (workers) is generally numerous and poor, or at best with middling income levels. The system is characterised by high income inequality.

In today’s liberal capitalism, however, a significant percentage of people receive incomes from both capital and labour (Milanovic 2019). It is still true that the share of one’s income derived from capital increases as we move higher in the income distribution, but very often the rich have both high capital and high labour incomes. While inter-personal income inequality may still be high, inequality in composition of income is much less.

The purpose of our study is to introduce a new way of looking at inequality that allows us to classify empirically different forms of capitalism. In addition to the usual inter-personal income inequality, we look at inequality in the factoral (capital or labour) composition of people’s incomes. The class analysis (where class is defined narrowly depending on the type of income one receives) is thus separated from the analysis of income inequality proper.

Which countries around the world are closer to classical, and which to liberal capitalism? Does classical capitalism display higher inter-personal income inequality than liberal capitalism? Can we find what we term ‘homoploutic’ societies – where everyone has approximately the same shares of capital and labour income? Would such homoploutic societies display high or low levels of income inequality?

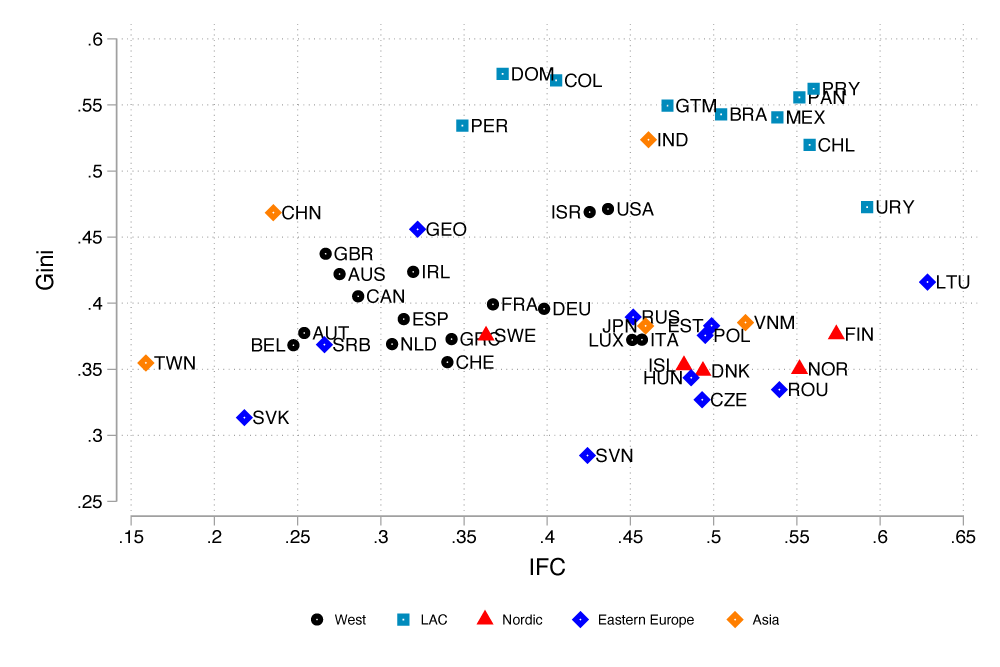

To answer these questions, in Ranaldi and Milanovic (2020) we adopt a new statistic, recently developed by Ranaldi (2020), to estimate compositional inequality of incomes: the income-factor concentration (IFC) index. The income-factor concentration index is at the maximum when individuals at the top and at the bottom of the total income distribution earn two different types of income, and minimal when each individual has the same shares of capital and labour income. When the income-factor concentration index is close to one (maximal value), compositional inequality is high, and a society can be associated to classical capitalism. When the index is close to zero, compositional inequality is low and a society can be seen as homoploutic capitalism. Liberal capitalism would lie in-between. Negative values of the income-factor concentration index, which describe societies with poor capitalists and rich workers, are unlikely to be found in practice.

By applying this methodology to 47 countries with micro data provided by Luxembourg Income Study from Europe, North America, Oceania, Asia, and Latin America in the last 25 years and covering approximately the 80% of world output, three main empirical findings emerge.

First, classical capitalism tends to be associated with higher income inequality than liberal capitalism (see Figure 1). Although this relationship was implicit in the minds of classical authors like Ricardo and Marx, as well as in recent studies of pre-WWI inequality in countries that are thought to have had strong class divisions (Bartels et al. 2020, Gómes Léon and de Jong 2018), it was never tested empirically.

Second, three major clusters emerge at the global scale. The first cluster is the one of advanced economies, which includes Western Europe, North America, and Oceania. Relatively low to moderate levels of both income and compositional inequality characterize this cluster. The US and Israel stand somewhat apart from the core countries since they display higher inequality in both dimensions.

Latin American countries represent the second cluster, and are, on average, characterised by high levels in both inequality dimensions.

The third cluster is composed of Nordic countries and is exceptional insofar as it combines low levels of income inequality with high compositional inequality. This is not entirely surprising: Nordic countries are known to combine wage compressions with ‘socially acceptable’ high returns to capital (Moene and Wallerstein 2003, Moene 2016). Such compromise between capital and labour (reached in the early 1930s) has put a cap on earning inequality within the region (Fochesato and Bowles 2015) but has left wealth inequality untouched (Davies et al. 2012). By drastically reducing the progressivity of capital income taxation (Iacono and Palagi 2020), income tax reforms during the 1990s have worked in the same direction.

Several other results are found. Many Eastern European countries are close to the Nordic cluster. Some (Lithuania and Romania) have very high compositional inequality, likely the product of concentrated privatisation of state assets. India is very similar to the Latin American cluster, displaying a class-based structure with high levels of income inequality.

Taiwan and Slovakia are, instead, the most ‘classless’ societies of all. They combine very low levels of income and compositional inequality. This makes them ‘inequality-resistant’ to the increase in the capital share of income. In other words, if capital share continues to rise due to further automation and robotics (Baldwin 2019, Marin 2014), it will not push inter-personal inequality up: everybody’s income would increase by the same percentage. The link between the functional and personal income distribution in such societies is weak – the topic of a previous VoxEU column by Milanovic (2017b). It is also interesting that Taiwan is both more ‘classless’ and less unequal than China.

The third, and perhaps most striking result that emerges from our analysis is that no one country in our sample occupies the north-west part of the diagram. We find no evidence of countries combining low levels of compositional inequality (like those of Taiwan and Slovakia) with extremely high levels of income inequality (like in Latin America).

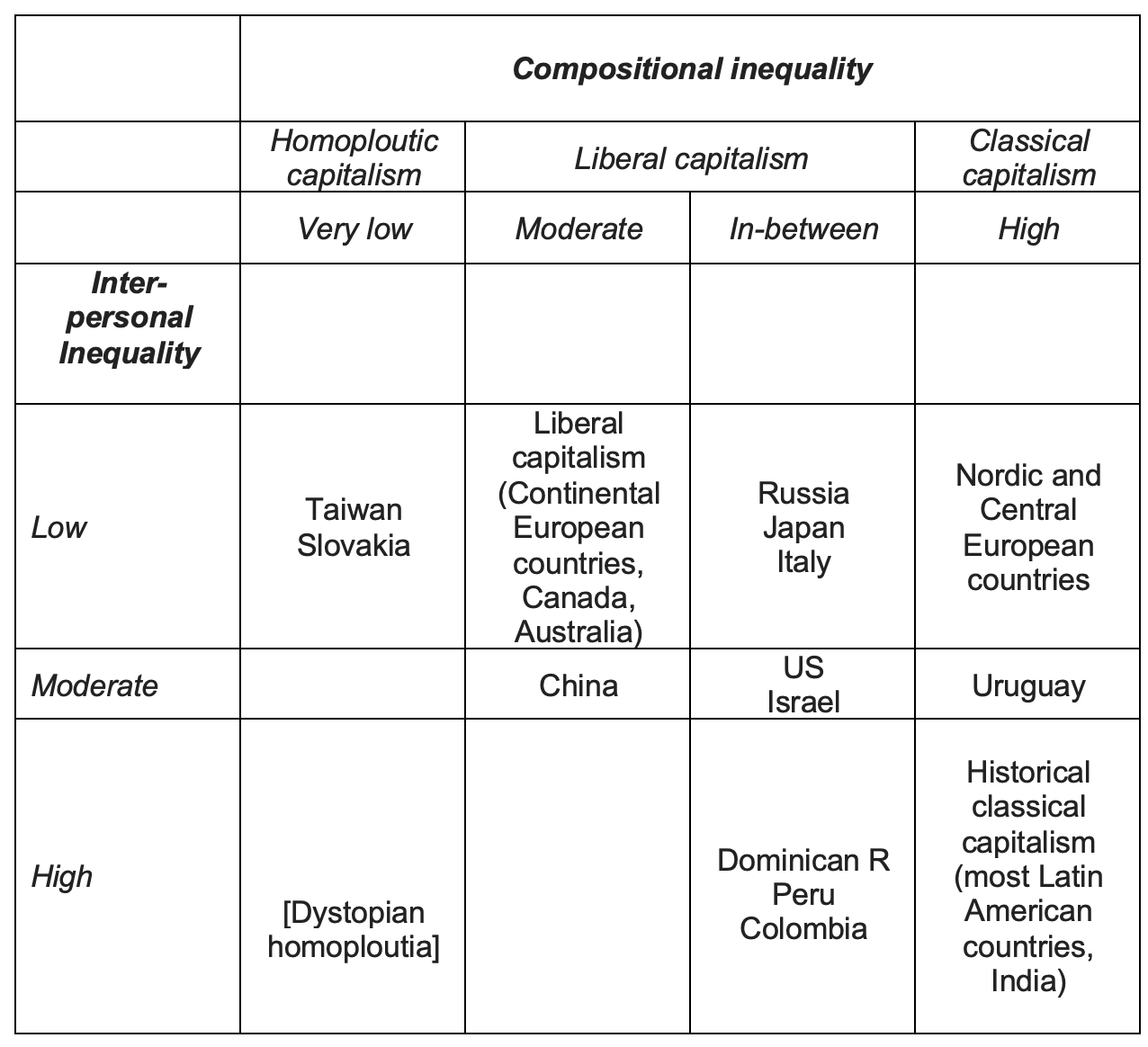

To conclude, we propose a novel taxonomy of varieties of capitalism on the basis of the two inequality dimensions (Table 1). We believe such taxonomy brings a strong empirical and distributional focus into the literature on the varieties of capitalism, as well as a larger geographical coverage.

References

Baldwin, R (2019), The Globotics Upheaval: Globalization, Robotics and the Future of Work, Princeton University Press.

Bartels, C, F Kersting and N Wolf (2020), “Testing Marx: Inequality, Concentration and Political Polarization in late 19th Century Germany”, German Institute for Economic Research.

Davies, J, R Lluberas and A Shorrocks (2012), Credit Suisse Global Wealth Report 2012.

Fochesato, M and S Bowles (2015), “Nordic exceptionalism? Social democratic egalitarianism in world-historic perspective”, Journal of Public Economics 127: 30-44.

Gómes Léon, M and H J de Jong (2018), “Inequality in turbulent times: income distribution in Germany and Britain, 1900–50”, Economic History Review.

Iacono, R and E Palagi (2020), “Still the Lands of Equality? On the Heterogeneity of Individual Factor Income Shares in the Nordics”, LIS working papers series 791.

Marin, D (2014), “Globalization and the Rise of the Robots”, Vox.EU.org, 15 November.

Marx, K (1992 [1867]), Capital: A Critique of Political Economy 1, translated by B Fowkes, London: Penguin Classics.

Marx, K (1993 [1885]), Capital: A Critique of Political Economy 3, translated by D Fernbach, London: Penguin Classics.

Milanovic, B (2017a), “Increasing Capital Income Share and its Effect on Personal Income Inequality”, in H Boushey, J Bradford DeLong and M Steinbaum (eds) After Piketty. The Agenda for Economics and Inequality. Cambridge, MA: Harvard University Press.

Milanovic, B (2017b), “Rising Capital Share and Transmission Into Higher Interpersonal Inequality”, Vox.EU.org, 16 May.

Milanovic, B (2019), Capitalism, Alone, Cambridge MA: Harvard University Press.

Moene, K O and M Wallerstein (2003), “Social democracy as a development strategy”, Department of Economics, University of Oslo 35/2003.

Moene, K O (2016), “The Social Upper Class under Social Democracy”, Nordic Economic Policy Review 2: 245–261.

Ricardo, D (2004 [1817]), The Principles of Political Economy and Taxation, London: Dover publications.

Ranaldi, M (2020), “Income Composition Inequality”, Stone Center Working Paper Series 7.

Ranaldi, M and B Milanovic (2020), “Capitalist Systems and Income Inequality”, Stone Center Working Paper Series 25.

Piketty, T (2014), Capital in the Twenty-First Century, translate by A Goldhammer, Cambridge, MA: Harvard University Press.

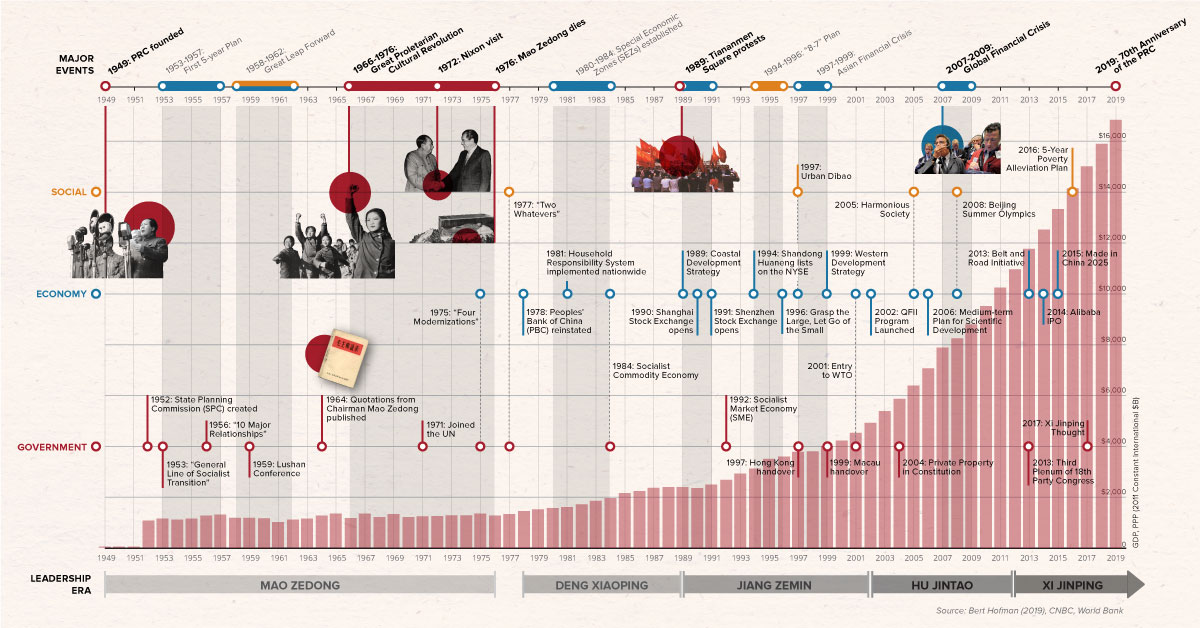

Rebalancing the Economy, Refurbishing the State: The Political Economic Logic of Sino-Capitalism in Contemporary China

China represents a highly significant case that can inform debates on the nature and logic of capitalism, especially those expressed in the wider Comparative Capitalisms (CC) literature. This is not just because of China’s sheer size and international economic influence, but also because China’s form of capitalism – Sino-capitalism – opens up new avenues for theoretical inquiry in CC. Specifically, Sino-capitalism’s constitution demonstrates the importance of Régulation Theory’s more open and evolutionary approach to understanding CC.

Sino-capitalism conceives China’s political economy as driven by the dialectic of top-down state-centric modes of governance interacting with bottom-up networked modes of entrepreneurship based on market competition. This contrasts with the more static comparative approaches in most of the CC literature. In particular, this conception highlights how compensatory institutional complementarities are central to understanding CC. To illustrate Sino-capitalism’s dynamic of reproduction, the article looks at recent policy initiatives that aim to rebalance China’s development model. Even though rebalancing incorporates more forceful economic liberalization, retaining and strengthening state control over crucial areas of socio-economic governance is central. China is therefore pursuing a policy package that seeks to strengthen state governance capacity and market forces in tandem, illuminating the chronic re-composition and rebalancing of institutional spheres via top-down/bottom-up dialectics shaping Sino-capitalism.

Introduction

China’s stunning economic transformation over the past 35 years still poses a puzzle for social scientific analyses. How could China’s obviously state-dominated development model produce such economic dynamism? Indeed, how has sustained market liberalization been combined with concerted efforts at strengthening state control over crucial areas of economy and society? And how has China undertaken far-reaching internationalization of its economy without sacrificing key elements of domestic policy autonomy?

In this article, I argue that the puzzle of China’s political economy can serve to inform salient debates on the nature and logic of capitalism highlighted in the Comparative Capitalisms (CC) literature (Deeg and Jackson, 2007; Jackson and Deeg, 2006; 2008). So far, conceptualizations of the crucial case of China remain at odds with each other and have found little resonance in the CC literature. For sure, most analyses of China in comparative political economy and economic sociology agree that China is, in fact, developing a form of capitalism. However, how to incorporate China’s form of capitalism both comparatively and theoretically in the CC literature remains a major challenge (Fligstein and Zhang, 2011; Peck and Zhang, 2013).

This challenge is also reflected in how CC literatures have so far faced difficulties in conceptually integrating emerging market economies. The narrow binary conception of Varieties of Capitalism (VoC) (Hall and Soskice, 2001) into Liberal Market Economies (LMEs) and Coordinated Market Economies (CMEs) never aimed to comprehensively cover emerging markets. Recent efforts within the CC literature have started to fill this conceptual gap. Much of the work has concentrated on Eastern Europe and, to a lesser extent, Latin America and East Asia (Bohle and Greskovits, 2012; Boyer et al., 2012; Hancké et al., 2007; Noelke and Vliegenthart, 2009; Noelke et al., 2014; Schneider, 2013).

All of these works go beyond the highly seductive parsimony of a binary distribution into LMEs and CMEs espoused by mainstream CC literature. Similarly, my analysis sees China as generating a novel form of capitalism – Sino-capitalism (McNally, 2007; 2012; 2015). Sino-capitalism’s analytical framework employs an open (Becker, 2009; 2014) inductive qualitative approach that conceives of “variegated” capitalisms globally (Jessop, 2012; Peck and Theodore, 2007; Streeck, 2010) and builds directly on insights in Régulation Theory (Aglietta, 1976; Lipietz, 1992; Boyer, 1990; 1997; 2005; Boyer et al., 2012). There is accordingly no “base” model of capitalism, but rather an assemblage of unique varieties of capitalism embedded in the global capitalist system.

I proceed by introducing the logic of Sino-capitalism, broadly conceived of as the macro-structural dynamics that define the mode of reproduction (cf. Boyer, 1990) and shape China’s contemporary political economic evolution. I then illustrate the dynamics driving Sino-capitalism’s institutional reproduction with recent policy initiatives that aim to rebalance China’s development model. Finally, the conclusion develops theoretical insights that can be generated from analyzing and conceptually extending the logic of Sino-capitalism.

My theoretical findings incorporate a call for more open and dynamic approaches that focus on the role of the state, the international embeddedness of national capitalisms, and the existence of contradictory/symbiotic politico-economic logics driving capitalist evolution. Quite pointedly, any conception of capitalist political economies must recognize the existence of different politico-economic spheres, each with its own logic or “Eigengesetzligkeit” (Weber, 1978; cf. Oakes 2003). Interactions among these spheres can generate a multiplicity of dynamics, ranging from symbiotic, reinforcing, counterbalancing, and compensatory, to contested and in discord.

Consequently, institutional complementarities under Sino-capitalism are not primarily conceived of as existing in a reinforcing state. Rather, compensating institutional complementarities have dominated and created dialectical dynamics of mutual adaptation and tension-ridden conditioning (cf. Evans, 1995). Sino-capitalism’s evolution thus represents an intriguing case of 35 years of extremely rapid and transformational institutional change that nevertheless exhibits a profound constant: a central dialectic of top-down state-guided capital accumulation existing side by side with bottom-up networks of entrepreneurs, market competition, and global economic integration.

1. The Logic of Sino-Capitalism

Most of these accounts stress one single aspect of China’s political economic evolution, but consequently miss the most central facet: the dialectical evolutionary dynamic of counterbalancing institutional complementarities driven by state guided forces top-down, by entrepreneurial networked forces bottom-up, and by global economic integration outside-in. In China’s emergent capitalism, state and private sector forces have mutually conditioned each other. The logic of Sino-capitalism attempts to capture these basic modalities of how China’s economic dynamism and political regime are replicated over time.

Analytically, the logic expresses the macro-structure shaping institutional and political reproduction, which, in turn, gives rise to China’s unique accumulation regime and modes of regulation. Insights from Régulation Theory (Aglietta, 1976; Lipietz, 1992; Boyer, 1990; 1997; 2005; Boyer et al., 2012) resonate directly in this conception. Paralleling other cases of capitalist evolution, China faced a critical juncture during the aftermath of the Cultural Revolution in the late 1970s as the Maoist regime’s legitimacy was questioned. A series of major political decisions to address this crisis created a new politico-economic compromise: private capital, both foreign and domestic, was gradually welcomed in China’s economy under the continued dominance of the Chinese Communist Party (CCP). This compromise, in turn, shaped the evolution and hybridization of specific sets of institutions defining Sino-capitalism.

In this context, the logic of Sino-capitalism can only be understood by conceptualizing China’s political economy as experiencing rapid international economic integration, especially intense participation in global value chains. Sino-capitalism forms by now an interdependent part of the neo-liberal global capitalist system. And finally, as Régulation Theory emphatically argues, capitalism does not tend towards stable equilibria, but rather is characterized by constant tensions and crises generated by its modes of reproduction. The dialectical logic of Sino-capitalism illustrates this volatile nature of capitalism strikingly.

The manner in which different institutional spheres interact means that Sino-capitalism differs from traditional conceptions of capitalist variety in important respects. Sino-capitalism is reproduced by a contradictory or dialectical quality: state-guided capitalism is tempered and at times challenged by dispersed private entrepreneurial forces that have created one of the world’s most dynamic and globalized private sectors. Sino-capitalism’s logic of reproduction thus derives from a specific institutionally-based notion of China’s emergent capitalism. Distinct institutional spheres are conceived of as interacting and mutually conditioning each other.

As a result, Sino-capitalism represents a distinctive institutional amalgam. Global integration, bottom-up networks of entrepreneurs, and top-down state guidance all coexist and balance each other’s dynamic elements, generating unique and diverse institutional complementarities. To illustrate, under Sino-capitalism’s eclectic policy outlook prices and market mechanisms are merely tools to an end: to develop China and make it wealthy and powerful. There is no a priori adherence to “free markets” as in a belief that fully liberalized market forces will generate the most efficient outcomes. Rather, controlled (often localized) policy experimentation is widely employed under long-term guiding principles. Most Chinese reforms have therefore constituted a work-around: they have employed measured market liberalization, though always under the condition that effective degrees of state control over the domestic economy remain intact.

The following develops further our understanding of Sino-capitalism’s logic by concentrating on three crucial sub-logics. Firstly, the central logic of reproducing a structurally rather stable dialectic of counterbalancing institutional spheres; secondly, and following from this sub-logic, a deliberately cautious pace of change that avoids radical departures from the past and tries to assure comprehensive state control over the reform process; and, finally, the interplay of state-centric development planning with local initiatives and policy trials bottom-up, a process that has generated much needed political space for economic experimentation and institutional innovation.

The propagation of a structurally rather stable dialectic which juxtaposes top-down state-guided capitalism with bottom-up networks of entrepreneurs, market competition, and global economic integration shapes Sino-capitalism’s logic most deeply. Although undergoing fundamental reform and massive growth, China’s political economy has continuously reproduced and recalibrated this dialectic. Chinese economic reform processes are accordingly not characterized by the dominant and stifling role of state-centric governance (Huang, 2008). Neither are they purely driven by entrepreneurial network-led accumulation from below (Nee and Opper, 2012). Counterbalancing institutional complementarities have actually conditioned, pressured, and mutually self-generated each other. These institutional spheres and their logics are sometimes in discord, but more often coexist and balance each other’s strengths and weaknesses (cf. Evans, 1995).

Critically, the logic of Sino-capitalism depends on the continuous adaptation of the CCP and Chinese state formations (Tsai, 2007; Dickson, 2008; Shambaugh, 2008). Chinese state firms, for example, began far-reaching reforms only after the development of private and quasi-private firms eroded their monopoly profits during the 1980s (Naughton, 1992). However, rather than attempting to smother private entrepreneurship, policy makers after 1992 concentrated on more fundamental restructurings of the state sector. State firms retreated from the most competitive and least profitable sectors in the Chinese economy, but kept a tight grip on industries populating the “commanding heights.”

The evolution of Sino-capitalism, therefore, does not represent a unilateral retreat of the state in favor of private entrepreneurial and market forces. Neither is it a story of initial liberalization followed by a full reassertion of statism (cf. Huang, 2008). The best way to understand Sino-capitalism’s dialectical logic is to focus on how private capital accumulation put pressures on the state to reform and adapt. State-initiated reforms and experimentation in turn enabled further private sector development, creating dynamic cycles of induced reforms, where each small step at restructuring created demands for further modifications (cf. Jefferson and Rawski, 1994; Naughton, 1995; Solinger, 1989).

In this view, top-down Leninist incentives focused on economic performance prodded local governments to compete vigorously for investment capital. This inter-jurisdictional competition led to the gradual liberalization of China’s economy and triggered substantial improvements in the investment climate facing both domestic private and foreign investors. In fact, state capitalist guidance and vibrant private entrepreneurship have tended to meet at the lower levels of the state apparatus, where local cadres have played a crucial role in accommodating and supporting individual capitalist accumulation.

The first phase of China’s reform and open door policy (1979-82) was marked by a major revolution top-down that changed incentives for CCP cadres to emphasize economic growth. The initial success of several experiments in both the state sector and the rural economy enabled a much more permissive regime for bottom-up entrepreneurship and experimentation in the 1980s. This first spurt of reform and opening, however, came to an end during 1989 as the party-state recentralized not only China’s politics, but also the economy. By 1992 reform impulses were once again unleashed by Deng Xiaoping’s “Southern Tour” (nanxun). Another phase of bottom-up capitalist accumulation then triggered by 1997 major reforms in the state sector and further privatization of local collectives, including the vast majority of Township and Village Enterprises (TVEs). By the 2000s the two process became more deeply intertwined, with both top-down (e.g., reforms triggered by China’s entry into the World Trade Organization after 2001) and bottom-up (e.g., massive inflows of foreign capital and the emergence of large Chinese private conglomerates) dynamics interacting simultaneously.

This dialectical logic is furthermore reflected in the unique policy mix employed to advance the reform process.This second sub-logic captures how most reform initiatives in China constitute a conscious work-around. For sure, reforms always aim to generate measured market liberalizations and economic efficiencies. However, they also intend to assure continued state control over the domestic economy and reform process. Full-scale economic liberalization, as in the “Big Bang” reforms of Eastern Europe and the successor republics to the Soviet Union, was consciously eschewed. In its place, the Chinese party elite favored innovative localized experimentation, institutional tinkering, and all kinds of work-around solutions that went beyond pure and simple economic liberalization. The results of this approach were stunning. Rather than experiencing the shocks generated by “Big Bang” reforms in Eastern Europe and Russia,the Chinese economy was able to relatively smoothly and gradually “grow out of the plan” to establish a market economy (Naughton, 1995). And in a similar fashion, China’s political economy evolved from an economic system characterized by complete state ownership to incorporate large swathes of private ownership and control (Oi and Walder, 1999).

One of the hallmarks of the policy process has been that most initiatives were cautious and gradualist. This does not mean that there were no spurts of reform, such as in 1992 after Deng Xiaoping’s “Southern Tour.” Similarly, contemporary reforms contained in the 60-point blueprint issued after the 18th Central Committee’s Third Plenum in November 2013 also hold the potential for reform breakthroughs. Top-down state coordination has consistently played a crucial role. Nonetheless, over the longer term key policy priorities have only shifted gradually in China. This has created an enduring and relatively constant policy environment, the “long-termism” of China’s “neo-etatist” planning (Heilmann, 2010).

The logic of Sino-capitalism is finally expressed in how central state coordination and localized policy trials have deeply interacted to create a rather novel experimental approach to economic and political-administrative reform (Florini et al., 2012). Every major policy change, such as the liberalization of foreign trade and investment, State-owned Enterprise (SOE) reforms, and the privatization of TVEs, was first tested with a variety of pilot projects, experimental regulations, as well as geographically defined special economic and industrial zones. Under these decentralized experiments bottom-up entrepreneurial and market pressures often created fertile ground for nominally illegal or unsanctioned behaviors. Over time, however, some formerly illegal behaviors were incorporated into local governance systems and accepted by central state formations, leading to continuous institutional adaptation (Florini et al., 2012; Tsai, 2002; 2007; Dickson, 2008). Equally significant, these trials and experiments left ample room for local ingenuity, learning, and ad hoc tinkering to work out problems in a gradual and, on the macro-level, controlled institutional environment.

China’s decentralized experimentalist approach to reform in a multi-layered state has created drawbacks and inefficiencies, most recently an “investment mania” in heavy industry that has generated large debt loads for industrial SOEs and local governments. Nevertheless, the dialectical interplay of state-centric development planning top-down and dispersed local initiatives bottom-up has created crucial space in an authoritarian system for institutional and policy innovation. Moreover, successful localized experiments are often scaled to provincial and national levels with strong central state guidance and efforts at standardization (Florini et al., 2012). This is “foresight maximum tinkering” – the “unusual combination of policy experimentation with long-term policy prioritization” (Heilmann, 2010: 109) that enables the pursuit of long-term priorities while leaving leeway to local ingenuity.

These three aspects of the logic of Sino-capitalism illustrate vividly how this emergent form of capitalism represents a complex new global capitalist force that falls outside dominant conceptualizations in CC. State-guided capitalism is balanced by entrepreneurially networked modes of capital accumulation that depend on the savvy of individual entrepreneurs exposed to market pressures. A cautious pace of change has avoided radical departures from the past and assured overall state control over the reform process. And the interplay of state-centric development planning with local initiatives and policy experiments opened up significant space for institutional innovation.

The propagation of Sino-capitalism’s unique dialectic is ultimately based on continuous processes of institutional learning, adaptation, and hybridization. The intermingling of market-oriented rules-based, flexible network-driven, as well as more purely statist governing approaches are all part of this reproduction. As a result, rapid and transformational institutional change has occurred under a rather constant framework of gradualism, retention of state economic guiding capacities, and the interplay of top-down planning with innovative localized experiments.

2. Rebalancing China’s Political Economy

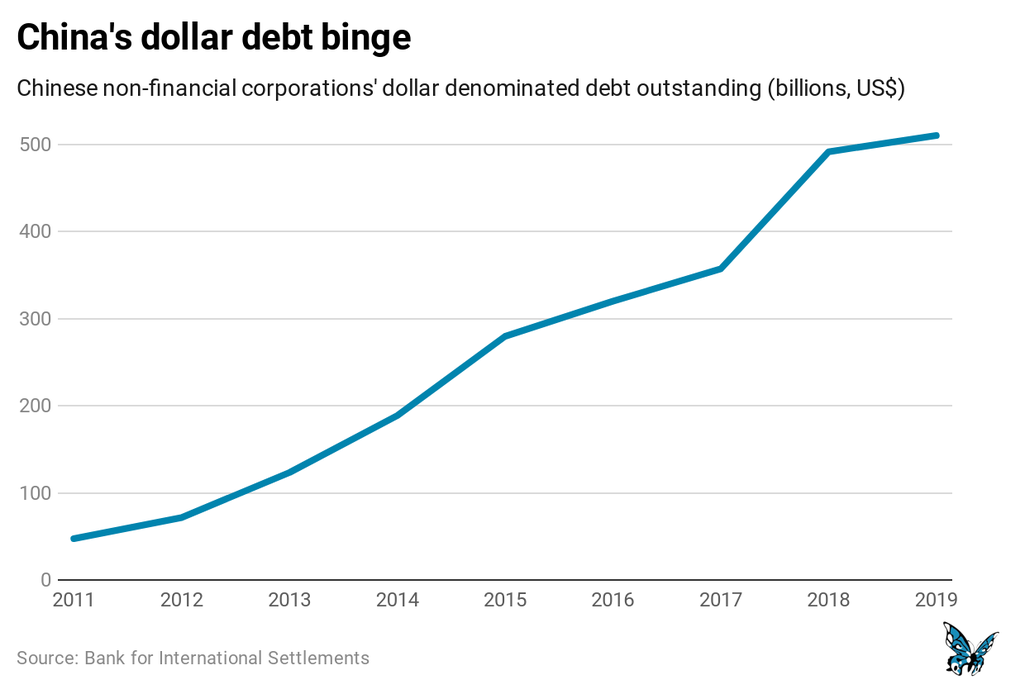

Over more than three decades China’s economic development relied on exploiting factors of production relatively abundant within the country. These included low wage labor, cheap land, and some mining resources. As capital accumulated, large savings in the state banking system were channeled into investment-driven growth during the 2000s, emphasizing large-scale investments in urban infrastructure, power generation, producer goods sectors such as steel, aluminum and cement, and export industries. This emphasis on investment- and export-driven development catapulted China to upper-middle income status, but by now is showing immense strains. Returns on investment are declining, while indebtedness is facing declining productivity and corporate profitability.

Consequentially, China’s investment- and export-driven development model was already around 2010 perceived to have reached the end of its sustainability (Naughton, 2010; Kroeber, 2009). In fact, both the 10th and 11th Five-Year Plans advocated a change to a more balanced and domestic consumption-driven development model. The 12th Five-Year Plan for 2011-2015 and the sweeping 60-point blueprint for economic, social, and legal reforms announced in late 2013 further amplify the policy foci outlined in these earlier pronouncements: the aim is to steer the Chinese political economy away from a concentration on growth above all else to balanced development.

Rebalancing China’s political economy implies a new growth model driven by consumption, innovation, and market forces with the overall aim of improving the Chinese people’s livelihood. The 60-point blueprint in particular outlines a host of reforms in the social, economic, and political-administrative spheres. However, interpretations of how exactly this shift will unfold are still prone to conceptual confusion. The 60-point blueprint has been looked at as far more ambitious and market-friendly than earlier reform efforts (Wharton School, 2013). It is seen as responding to various criticisms of China’s hitherto state-guided development model. These critiques stress that reforms should redefine the role of government, restructure state enterprises and banks, develop the private sector, promote competition, and deepen market reforms (World Bank and Development Research Center of the State Council, 2012: xv; cf. Kroeber, 2009).

In the view of liberally inclined Chinese economists, distorted resource allocations in China are mainly due to the continued dominance of SOEs in many crucial infrastructure and producer goods sectors. Since these sectors are often characterized by monopolistic or oligopolistic competitive environments, SOEs have become a major drag on efficiency. Assuring future economic growth must thus focus on the reorganization and privatization of large swaths of the Chinese state sector (Personal communication with researchers of the Development Research Center, October 2012).

Clearly, market liberalization and measured privatization enjoys potential support among segments of China’s economic policy-making community, including some top leaders.And strengthening market forces undoubtedly represents an important component of any rebalancing of the Chinese political economy. Nonetheless, envisioning that China will simply opt for full-out economic liberalization and privatization neglects a deeper understanding of the dynamics driving China’s political economy: the logic of Sino-capitalism. As before, the Chinese party-state is unlikely to pursue a full-blown policy of free-market reform. The emphasis continues to rest on avoiding economic liberalization’s potential dangers. The 60-point blueprint and more recent policy pronouncements make clear that there will be no radical departures from the past.

2.1 The 60-Point Blueprint of 2013

The sweeping blueprint announced in late 2013 covers a wide range of issues. Its 60 points or aspects include about 330 individual measures. Everything from changes in the one-child policy, car emissions standards, reforms to the hukou residency system, to interest rate liberalization is covered. The central objectives, though, reflect the dynamic qualities of Sino-capitalism. At first, substantial plans for economic and social liberalization stand out. According to the blueprint, the market should start to play the “decisive function in resource allocation” (Wharton School, 2013). Both academic and business analysts have thus seen it as ushering in significant market-oriented reforms. Avery Goldstein notes that the blueprint turned out to be “far more detailed, far more ambitious, far more unreservedly pro-market reform than many outsiders expected” (Wharton School, 2013; cf. Naughton, 2014).

One of the most prominent areas of liberalization that is highlighted in the blueprint concerns financial reform. Interest rates are to be fully liberalized but not before a deposit insurance system is set up. Similarly, capital account liberalization and with it the internationalization of the Chinese Yuan are to proceed, but again at first limited in scope, such as in the experiments being undertaken in China’s four newly established Free Trade Zones in Shanghai, Tianjin, Shenzhen, and Fujian Province.

Upon closer analysis, therefore, it becomes clear that the Chinese party-state is nowhere close to pursuing a pure free-market platform. The leadership under Xi Jinping, as its predecessors, is attempting to avoid the pitfalls that often accompany economic liberalization, especially the risks underlying financial liberalization. A deliberate, cautious pace of change is preferred that aims to avoid at all costs major mistakes that could destabilize society and threaten CCP rule. Moreover, many of the reform measures in urbanization, social welfare provision, and the environment will ultimately necessitate more effective state regulation and guidance, not just liberalization and deregulation.

The blueprint reflects this fine balancing act in its call for a new role for government and a new relationship between government and market. Reforms ultimately follow the essence of Sino-capitalism’s logic: a cautious pace of change that employs work-around solutions and avoids radical departures; the interplay of state-guided development planning with local initiatives and policy experiments; and the dialectic quality of Sino-capitalism that calibrates relations between top-down state-centric modes of governance and bottom-up global-, network-, and market-driven modes.

From the leadership’s points of view this approach is seen as politically necessary, since powerful political interests that could see new reforms as threats to their power and well-being will have to be contained, co-opted, or sidelined. These interests, many of which have benefited immensely from the old system, include the leaders of many large state and private firms, as well as various professional classes including the state technocratic elite itself. Conversely, socio-political interest groups who are likely to see benefits remain politically weak in China, in particular farmers and urban workers.

So the CCP moves gradually and cautiously to avoid the risk that economic reforms could get out of hand and create a political backlash. Economic and market liberalization measures are fine tuned with concerted efforts to sustain and strengthen state control over society and economy, including focused learning, adaptation, institution building, and social reform. I briefly highlight one policy arena that stands at the center of these dynamics: state sector reforms.

2.2 State Sector Reforms

China’s domestic imbalances are in part due to an overemphasis on the state sector, especially heavy industry. Although most state firms have been corporatized and listed on stock markets, they continue to act as quasi-monopolies or operate in managed oligopolies. Due to their strategic role in the economy, they receive enormous support from government agencies and the state-owned financial system.

The blueprint’s economic reform proposals clearly adopt a pro-market rhetoric and are supportive of private enterprise. Private firms should be given more room, equal property rights protection, and gain access to markets and sectors hitherto dominated by the state sector. However, the continued centrality of the state sector in the economy is reiterated as well: “adhere to the principal position of the public ownership system, give play to the dominant role of the public sector economy, and continually strengthen the vitality, control and influence of the public sector” (China Copyright and Media, 2013). The proposals, in broad brushstrokes, display efforts at encouraging private sector development and innovation, but focus equally on restructuring the state-owned economy.

Many of the SOE governance reforms suggested in the blueprint represent ongoing initiatives that have, in some cases, been in place for over a decade: price reforms should be continued in some basic infrastructure sectors, such as power and energy; more public disclosure of SOE finances be made available; the enterprise bankruptcy system improved; and long-standing attempts to fully separate government agencies from operational SOEs and their assets, especially in the remaining monopoly sectors, implemented.In this context, SOEs should complete their conversion into “modern enterprises” – joint-stock companies with up-to-date corporate governance. These conversions can include movements towards mixed-ownership systems, where in some exceptional cases private interests could take controlling stakes in existing SOEs. But overall the state should change the way it exercises its ownership, transitioning from “asset management” to “capital management.” New state-owned investment funds should be established, and some equity stakes in existing SOEs transferred to them, thus bringing specialized (state-owned) financial managers into the fold (Naughton, 2014).

Reforms thus include opportunities for private parties to gain ownership shares in some SOEs and enter into sectors so far controlled by SOEs. Several initiatives, for instance, attempt to separate infrastructure management from the actual operation of infrastructure services. The services can then be opened to private firms that can enter as service providers and create more competitive pressures. These reforms are similar in conception to reforms being implemented after breaking up the Railway Ministry in March 2013.

Perhaps one of the biggest changes on Chinese SOE performance could emanate from financial sector reforms.So far, SOEs have benefited substantially from financial repression in China’s domestic economy and the dominance of large state banks. Under these conditions most SOEs have access to plentiful and cheap credit, providing them with a competitive advantage both domestically and internationally. Building on the 60-point blueprint, financial reforms implemented in recent years encompass fully liberalizing interest rates and opening up the banking sector to more competition. This could subject borrowing by both SOEs and private entities to a more market-driven financing environment. Reform proposals also include permission for companies to launch initial public offerings without official approval, under a new “share issuance registration system.” However, much of these reform proposals remain a work in progress.

Another important reform initiative aims to increase the dividend payout ratio for SOEs from the current 5-15 percent to 30 percent by 2020. Already begun around 2007, this policy attempts to extract a larger share of state sector profits into the state treasury. It rests on the implementation of a “state capital management budget” (guoyou ziben jingying yusuan) that aims to steadily raise the dividend payout ratio of SOEs, thus lessening the leeway for SOEs to engage in overinvestment, a fact that has generated large industrial overcapacities (Naughton, 2006).

The blueprint’s objective of a roughly 30 percent dividend pay-out ratio from post-tax profits would put Chinese SOEs in line with common international norms. However, it is not clear at present if the Chinese government will be successful in exercising this aspect of its property rights. SOEs have shown a reticence to follow central guidelines and been characterized by various governance gaps. They are thus one of the main targets of Xi Jinping’s massive anti-corruption campaign. Undoubtedly, since Xi came to power in 2012 the hallmark of his leadership and greatest source of his popularity has been the relentless anti-corruption campaign. The campaign has deeply influenced SOE governance and targeted in particular SOEs in sectors that are seen as “fiefdoms” onto their own, not fully under the control of the CCP party-state.

The anti-corruption campaign demonstrates the prominence of party-state centralization in China’s dialectical reform dynamics. While some aspects of state sector reform are clearly aimed at introducing competitive market pressures, others aim to reassert state authority. Proposed pay-cuts to SOE executive salaries that the CCP Politburo approved in September 2014 represent one intriguing example. The new policy specifies that SOE executives who were appointed by the CCP Organization Department with a bureaucratic rank carrying substantial benefits and perks could face deep pay cuts of about 60 percent (Zhang, 2014). After implementation, such executive would again be treated as pure bureaucrats, since they have opportunities for career advancement in the party-state hierarchy. Conversely, those executives appointed competitively from outside the party-state hierarchy, who do not carry a bureaucratic rank, and who often have generous pay packets, would see no change.

The policy aims to make SOE executives choose between “working for the government” and working for “the enterprise” (Zhang, 2014). Interestingly, most SOE executives with bureaucratic rank are intent on keeping it and thus taking a pay-cut. They continue to see themselves and their SOEs as part of the larger CCP party-state hierarchy, and often have ambitions beyond any particular SOE to advance into the top levels of party- or state-administrative leadership (Personal communication with Kjeld Erik Brødsgaard, April 2016). This reform proposal marks a step away from market-based pay packages and hiring in the Chinese state sector, and, consequently, looks retrograde. However, it forms part of wider SOE reforms that aim to distinguish among state firms situated in monopoly industries and in public welfare, which are to be recentralized under closer scrutiny from the government, and those in competitive fields, which face further commercialization and exposure to market forces.

One good example that sums up China’s cautious and quiet reform approach regards the large oil and gas corporations: CNPC, CNOOC, and Sinopec. A series of experimental, incremental, and seemingly fragmented steps, including several pilot-based reforms aim to gradually transform the operating environment of these three giants. For example, oil import licenses have been granted to private firms, thus enabling them to compete with state-owned refiners. The Chinese government also has approved the first privately-led mega-refinery in Zhoushan, Zhejiang, which will compete head-to-head with Sinopec in that region. And a low-profile pilot-restructuring of Sinopec’s overseas exploration unit, SIPC, does not aim to privatize it, but rather to bring state-owned investment vehicles, such as Chengtong Holdings Group and China Reform Holdings, on board as strategic investors. These two state-owned investors will hold a combined shareholding of 70 percent of SIPC (Chen and Meng, 2016). This reform pilot reflects one of the central planks of contemporary SOE reform: state-owned investment corporations are being formed and tasked with employing their financial specialists to craft market-oriented strategies that can change management behaviors and capital structures.

In the end, the large oil and gas SOEs are seen as key economic stabilizers for the national economy. Following the logic of Sino-capitalism, the CCP party-state wants to maintain strong control over them and only implement moderate changes after conducting experiments and localized trials. This fundamental thrust of reforms is also apparent in China’s newest reform slogan: supply-side reforms.

2.3 Supply-Side Structural Reform

So far it is unclear what exactly this new reform initiative will encompass and what specific policies fall under the supply-side banner (Wong, 2016). Some argue for tax cuts for private businesses and reducing the government burden on investors. This clearly echoes the tax cut and deregulation policies advocated by conservative Western leaders in the 1980s. But the most important thrust seems to be efforts at diminishing overcapacity in industries such as steel, cement, aluminum, coal, and others. Mines and factories in sectors producing far more than the market demands should be shut down or merged.

As Xi Jinping put it when arguing for the importance of this reform for the long-term well-being of the Chinese economy, “The main direction (of the reform) is to reduce ineffective supply, increase effective supply, and make the supply structure more fitting to the demand structure” (Wang and Xin, 2016). However, closing down inefficient “zombie” corporations, many of them SOEs, will carry substantial economic, social, and political costs. More than three million people in the steel, coal, and similar industries could lose their jobs if proposed restructurings go through. On February 29, 2016 government sources announced a potential of 1.8 million steel and coal worker lay-offs, around 15 percent of the work force in those industries. However, no exact time frame was given for implementing this capacity reduction (Yao and Meng, 2016).

Certain provinces, like Shanxi and Hebei with large coal and steel industries, could face particular hardship. Shanxi, China’s largest coal mining province, has already been the focus of economic restructuring to reduce overcapacity. Annual GDP growth has declined by half since 2014, to reach a low of 3.1 percent in 2015. And the debt accumulated by the seven major state-owned coal firms in the province reached the size of the province’s entire GDP in 2015 (Ye and Marro, 2016). Nevertheless, Shanxi province plans to cut its coal production even further, by some 258 million tons by 2020. Similarly, Hebei province aims to contain its steel and cement capacities to 200 million tons each by that time. Evidently, the reforms will necessitate large fiscal transfers to cushion the concentrated burdens that fall on particular regions and industries.

Another major plank of supply-side reforms involves mega-mergers among large SOEs to gain international market share and competitive heft. The most prominent example so far has been the merger of China’s two state-owned train makers, China CNR Corp. and CSR Corp., in mid-2015. The Chinese government is also planning or implementing mergers of the country’s major metals companies, nuclear technology firms, and the two largest shipping lines (Yu, 2016).

This reflects once more the dialectical qualities of Sino-capitalism. Mega-mergers are intended to form national champions that can better compete abroad. However, they are also likely to reduce competition domestically and continue inefficiencies, especially if strong SOEs are forced to merge with weaker ones. Similarly, state sector reforms aim to give private investors bigger stakes in a wider range of SOEs, but they clearly rule out full privatization. And more generally, Xi Jinping has shown a distinct penchant for centralizing power, but simultaneously his government has put forward many reform proposals that aim to restrain the reach of the state.

In the final analysis, the sweeping 60-point blueprint and recent supply-side reform initiatives continue the search by China’s leadership for policy solutions that can effectively reform the economy while retaining crucial elements of central state control. They reflect the dialectical structure of Sino-capitalism: various state-centric endeavors and concerted efforts to augment state power are juxtaposed with circumscribed economic liberalization and the active encouragement of private entrepreneurship and technology innovation.

The rebalancing reforms proposed under Xi Jinping thus conform to the basic evolutionary logic of Sino-capitalism. Experimental, circumscribed, and cautious measures exemplify the intricate interplay of state-centric development planning with local initiatives and policy experiments. Over time, they are likely to reproduce the dialectic of Sino-capitalism while rebalancing China’s development model. In a recalibrated form top-down state-guided capitalism is likely to continue its dialectical relationship with capital accumulation based on private entrepreneurship and innovation, market competition, institutional learning, and global integration.

3. Implications for The Study of Comparative Capitalisms

As the above illustrated, recent reform proposals in China do not indicate a full-blown turn towards a liberal market economy. Quite to the contrary, they seek to retain and strengthen state control over crucial areas of socio-economic governance. The Xi Jinping leadership is thus pursuing a policy package that seeks to strengthen the private sector, domestic consumption, and indigenous innovation all the while refurbishing the CCP party-state’s governing capacity.

Therefore, in the task of rebalancing China’s development model there is no indication of efforts to directly supersede the dialectical dynamics of Sino-capitalism. For sure, measured steps at economic liberalization are planned. But these form efforts to refurbish state-coordination and its interactions with other institutional spheres, not to fundamentally destabilize Sino-capitalism’s chronic re-composition and recalibration of institutional spheres via top-down/bottom-up dialectics.

The theoretical comparative implications of this mode of capitalist reproduction for the CC literature are substantial. The logic of Sino-capitalism underlines that our understanding of capitalist evolution must be opened up to incorporate the central role of the state, the international embeddedness of national capitalisms, and the existence of contradictory/symbiotic politico-economic logics. It ardently stresses insights from Régulation Theory and its related approaches (Becker, 2009; 2014; Jessop, 2012; Peck and Theodore, 2007; Aglietta, 1976; Lipietz, 1992; Boyer, 1990; 1997; 2005; Boyer et al., 2012).

The logic of Sino-capitalism peals away the veneer of capitalist stability and institutional coherence seemingly prevalent in the already developed political economies. Capitalism is at base unruly. For Régulation Theory capitalism does not tend towards equilibrium but rather towards crisis in the longer term (Boyer, 2005). It must perpetually reinvent itself, creating ultimately disruptive change. This is evidenced by the empirical literature, which shows that capitalisms are “institutionally fragmented, internally diverse, and display greater ‘plasticity’” (Deeg and Jackson, 2007: 157) than the parsimonious dichotomy of LMEs and CMEs implies.

The logic of Sino-capitalism further highlights how capitalist political economies are constituted by different politico-economic spheres, each with its own logic or “Eigengesetzligkeit” (Weber 1978; cf. Oakes 2003). A multiplicity of potential interactions is possible among these spheres, ranging from symbiotic, reinforcing, counterbalancing, and compensatory, to tension-ridden and contested. In such a perspective, the unruly, effervescent nature of how capitalism reproduces itself – the system’s need for perpetual expansion, disruption, and reinvention – stands front and center.

Among these spheres, that of the state looms large. Early CC approaches, especially the Variety of Capitalisms perspective (Hall and Soskice, 2001), granted little autonomy to the state. These analyses thus lost sight of the state’s inherent macro-structuring role. Boyer (1997; 2005) in his conception of capitalist diversity incorporates “statist capitalism” and “state-directed capitalism.” Greater attention is paid to the degree of stateness, a theme echoed by Vivien Schmidt (2012) when sheconceptualizes “state-influenced market economies” with reference to Italy, France, and Spain.

Recent literature on emerging capitalisms develops this theme further (Boyer et al., 2012; Bohle and Greskovits, 2012; Schneider, 2013). As with Sino-capitalism, the inherent diversity of these capitalisms is stressed, in particular the state’s different roles. Vivien Schmidt (2009; 2012) pointedly suggests that the state must be treated as an autonomous political-economic actor, deviating from many other CC approaches. Rather than disaggregating the state into its historical institutional components or the strategic actions of state elites, it must be viewed as architectonic, incorporating political struggles over ideas, policies, and power that fundamentally structure each variety of capitalism (cf. Amable, 2003; Streeck, 2009).

The Chinese state under Sino-capitalism crystallizes such an architectonic structuring role remarkably well. In practically every sphere of the economy the Chinese state remains a major force structuring national, local, and firm-level policies (Szelenyi, 2010). Sino-capitalism also exemplifies the importance of state adaptability, social accommodation, and a multitude of regulatory modes ranging from dirigiste to liberal laissez-faire, creating in turn several distinct regimes of production in the Chinese political economy (Luthje, 2013). One of the most interesting aspects relates to the Chinese state’s compensating role in reproducing the institutional and power relations sustaining Sino-capitalism.

The logic of Sino-capitalism relies, as other varieties of capitalism, on unique institutional complementarities. These create interlocking institutional isomorphisms sustaining competitive advantages and stabilities in the Chinese accumulation regime. They also imbue Sino-capitalism’s distinct dialectical structure and dynamics with a certain path-dependency. However, Sino-capitalism’s institutional complementarities differ from the mainstream conception of reinforcing complementarities (Hall and Soskice, 2001; cf. Amable, 2003).

Under Sino-capitalism, the balancing of institutional spheres relies on the amalgamation of state-led coordination top-down with flexible and entrepreneurial network capitalism bottom-up. This means that complementarities are characterized by constant tensions, power struggles, as well as adaptation and experimentation. As Deeg and Jackson (2007) note, many types of capitalism are characterized by tensions among different institutional spheres, since each sphere follows different logics. Indeed, Boyer (2005) and Crouch (2005) hold that true complementarity connotes institutions following different structural logics, “where components of a whole mutually compensate for each other’s deficiencies” (Crouch, 2005: 359).

Sino-capitalism is ultimately co-determined by unlike institutional logics that balance each other’s strengths and weaknesses. Actors have diverse options and capacities that facilitate cross-fertilization, creating openings for institutional learning, tinkering, experimentation, and transformation. Sino-capitalism’s tension-ridden dialectic complementarity should therefore be seen as contributing to, rather than undermining, the overall competitiveness and developmental sustainability of China’s political economy. Hybridization and messiness may hold distinct advantages.

Naturally, the hybrid, complex, and dialectical aspects of Sino-capitalism express fundamental contradictions that could someday come to the fore, destabilizing the system, and triggering a fundamental crisis of the political economy. All cases of capitalist evolution are historically indeterminate. Present political and economic dissonances in China already are an indication of increasing strains. Under the scenario of a major politico-economic crisis, Sino-capitalism could face a critical juncture at which point a new logic of capitalism supersedes it. It is therefore absolutely conceivable that Sino-capitalism could face a rupturing in coming years.

Nonetheless, the various policies announced to rebalance China’s political economy so far show that without major political upheaval the dialectical dynamics of Sino-capitalism are likely to be reproduced over time. Continuous gradual reforms in the realms of economic liberalization and institution-building, especially to establish a more effective regulatory state, do not imply a fundamental change. Sino-capitalism’s evolutionary logic could be replicated well into the future.

Regardless of the potential outlook for Sino-capitalism, explorations of its logic open up new avenues for theoretical inquiry in CC. The aspects of the logic analyzed in the foregoing expand our understanding of capitalist evolution to include state-capital dynamics and compensatory institutional complementarities. Perhaps most importantly, the dialectical evolutionary quality of Sino-capitalism contrasts with the more static comparative approaches in most of the CC literature, obliging us to recognize capitalism as in a perpetual state of disequilibrium and tension.

Christopher A. McNally

Bibliography

Aglietta, Michel, 1976. A Theory of Capitalist Regulation: The US Experience, London: Verso.

Amable, Bruno. 2003. The Diversity of Modern Capitalism, Oxford: Oxford University Press.

Becker, Uwe, 2009. Open Varieties of Capitalism: Continuity, Change and Performances. Basingstoke: Palgrave Macmillan.

Becker, Uwe (ed) 2013. The BRICs and Emerging Economies in Comparative Perspective: Political Economy, Liberalisation and Institutional Change, London and New York: Routledge.

Beeson, Marc (2009), “Developmental states in East Asia: A comparison of the Japanese and Chinese experiences”, Asian Perspective, vol. 33, no 2, p. 5-39.

Bohle, Dorothee, and Béla Greskovits (2012), Capitalist Diversity on Europe’s Periphery, Ithaca, NY: Cornell University Press.

Boyer, Robert. 1990. The Regulation School: A Critical Introduction (Translated by Craig Charney), New York: Columbia University Press.

Boyer, Robert (1997), “French statism at the crossroads”, in Political Economy of Modern Capitalism: Mapping Convergence and Diversity, Crouch, C. and W. Streeck (eds), London: Sage, p. 71-102.

Boyer, Robert (2005), “How and why capitalisms differ”, Economy and Society vol. 34, no 4, p. 509-557.

Boyer, Robert, Hiroyasu Uemura, and Akinori Isogai (eds) (2012), Diversity and Transformations of Asian Capitalisms, London and New York: Routledge.

Chen, Aizhu and Meng (2016), “No big bang, but quiet reforms reshaping China’s oil and gas sector”, Reuters, May 11; available at: http://www.reuters.com/article/us-china-reform-energy-idUSKCN0Y22RH (accessed May 21, 2016).

China Copyright and Media (University of Oxford) (2013), “Communiqué of the 3rd Plenum of the 18th Party Congress”, November 12; available at: http://chinacopyrightandmedia.wordpress.com/2013/11/12/communique-of-the-3rd-plenum-of-the-18th-party-congress/ (accessed June 29, 2014).

Crouch, Colin (2005), “Three meanings of complementarity”, Socio-Economic Review, vol. 3, no 2, p. 359-363.

Deeg, Richard, and Gregory Jackson (2007), “Towards a more dynamic theory of capitalist variety”, Socio-Economic Review, vol. 5, no 1, p. 149 –179.

Dickson, Bruce J. (2008), Wealth into Power: the Communist Party’s Embrace of China’s Private Sector, Cambridge: Cambridge University Press.

Evans, Peter B. (1995), Embedded Autonomy: States and Industrial Transformation, Princeton, NJ: Princeton University Press.

Fligstein, Neil, and Jianjun Zhang (2011), “A new agenda for research on the trajectory of Chinese capitalism”, Management and Organization Review vol. 7, no 1, p. 39-62.

Florini, Ann M., Hairong Lai, and Yeling Tan (2012), China Experiments: From Local Innovations to National Reform, Washington D.C.: Brookings Institution Press.

Hall, Peter A., and David Soskice (2001), “An introduction to varieties of capitalism”, in Varieties of Capitalism: The Institutional Foundations of Comparative Advantage, Hall, P.A. and D. Soskice (eds), Oxford: Oxford University Press, p. 1-68.

Hancké, Bob, Martin Rhodes, and Mark Thatcher(eds)(2007), Beyond Varieties of Capitalism: Conflict, Contradictions, and Complementarities in the European Economy, Oxford: Oxford University Press.

Heilmann, Sebastian (2010), “Economic governance: Authoritarian upgrading and innovation potential”, in China Today, China Tomorrow: Domestic Politics, Economy and Society, Fewsmith, J. (ed), Lanham, MD: Rowman and Littlefield, p. 109-126.

Hsing, You-tien (1998), Making Capitalism in China, New York: Oxford University Press.

Huang, Yasheng (2008), Capitalism with Chinese Characteristics: Entrepreneurship and the State, New York: Cambridge University Press.

Jackson, Gregory, and Richard Deeg (2006) “How many varieties of capitalism? Comparing the comparative institutional analyses of capitalist diversity”, MPIfG Discussion Paper 06/2, Cologne: Max Planck Institute for the Study of Societies.

Jackson, Gregory, and Richard Deeg (2008), “From comparing capitalisms to the politics of institutional change”, Review of International Political Economy, vol. 15, no 4, p. 680-709.

Jefferson, Gary H., and Thomas G. Rawski (1994), “Enterprise reform in Chinese industry”, Journal of Economic Perspectives, vol. 8, no 2, p. 47-70.

Jessop, Bob (2012), “Rethinking the diversity and variability of capitalism: On variegated capitalism in the world market”, in Capitalist Diversity and Diversity within Capitalism, Wood, G. and C. Lane (eds), London: Routledge, p. 209-237.

Knight, John B. (2014), “China as a developmental state”, The World Economy, vol. 37, issue 10, October, p. 1335-1347.

Kroeber, Arthur (2009), “Economic rebalancing: China’s turning point”, China Economic Quarterly, vol. 13, no 3, p. 23 –24.

Lipietz, Alain (1992), Towards a New Economic Order: Post-Fordism, Democracy and Ecology, Oxford: Oxford University Press.

Lüthje, Boy (2013), “Diverging trajectories: Economic rebalancing and labour policies in China”, Journal of Contemporary Chinese Affairs, vol. 42, no 4, p. 105-137.

McNally, Christopher A. (2007), “China’s capitalist transition: The making of a new variety of capitalism”, Comparative Social Research (special issue on Capitalisms Compared, Lars Mjosset and Tommy H. Clausen, eds), vol. 24, p. 177-203.

McNally, Christopher A. (2012), “Sino-Capitalism: China’s reemergence and the international political economy”, World Politics, vol. 64, no. 4, p. 741-776.

McNally, Christopher A. (2015), “The political economic logic of RMB internationalization: A study in Sino-capitalism”, International Politics, vol. 52, no 6, p. 704-23.

Naughton, Barry (1992), “Implications of the state monopoly over industry and its relaxation”, Modern China, vol. 18, no 1, p. 14-41.

Naughton, Barry (1995), Growing out of the Plan: Chinese Economic Reform, 1978–1993, New York: Cambridge University Press.

Naughton, Barry (2006), “Claiming profit for the state: SASAC and the capital management budget”, China Leadership Monitor, no 18, spring.

Naughton, Barry (2010), “The policy challenges of post-stimulus”, Global Asia, 22 June: available at: https://www.globalasia.org/wp-content/uploads/2010/06/336.pdf (accessed May 25, 2016).

Naughton, Barry (2014), “After the Third Plenum: Economic reform revival moves toward implementation”, China Leadership Monitor, no 43, spring.

Nee, Victor, and Sonja Opper (2012), Capitalism from Below: Markets and Institutional Change in China, Cambridge, MA: Harvard University Press.

Noelke, Andreas, and Arjan Vliegenthart (2009), “Enlarging the varieties of capitalism: The emergence of dependent market economies in East Central Europe”, World Politics, vol. 61, no 4, p. 670-702.

Noelke, Andreas, Tobias ten Brink, Simone Claar, and Christian May (2014), “Domestic structures, foreign economic policies and global economic order: Implications from the rise of large emerging economies”, European Journal of International Relations, vol. 21, issue 3, p. 1-30.

Oakes, Guy (2003), “Max Weber on value rationality and value spheres”, Journal of Classical Sociology, vol. 3, no 1, p. 27-45.

Oi, Jean C. (1992), “Fiscal reform and the economic foundations of local state corporatism in China”, World Politics, vol.45, no 1, p. 99 –126.

Oi, Jean C., and Andrew Walder (eds) (1999), Property Rights and Economic Reform in China, Stanford: Stanford University Press.

Peck, Jamie, and Nik Theodore (2007), “Variegated capitalism”, Progress in Human Geography, vol. 31, no 6, p. 731-772.

Peck, Jamie, and Jianjun Zhang (2013), “A variety of capitalism with Chinese characteristics?” Journal of Economic Geography, vol. 13, no3, p. 357-396.

Schmidt, Vivien A. (2009), “Putting the political back into political economy by bringing the state back yet again”, World Politics, vol. 61, no 3, p. 516-548.

Schmidt, Vivien A. (2012), “What happened to the state-influenced market economies (SMEs)? France, Italy, and Spain confront the crisis as the good, the bad, and the ugly”, in TheConsequences of the Global Financial Crisis, Grant, W. and G. K. Wilson (eds), Oxford: Oxford University Press, p. 156-186

Schneider, Ben R. (2013), Hierarchical Capitalism in Latin America: Business, Labor, and the Challenges of Equitable Development, New York: Cambridge University Press.

Shambaugh, David L. (2008), China’s Communist Party: Atrophy and Adaptation, Berkeley and Los Angeles, CA: University of California Press.

Solinger, Dorothy J. (1989), “Capitalist measures with Chinese characteristics”, Problems of Communism, vol. 38, no 1, p. 19-33.

Streeck, Wolfgang (2009), Re-forming Capitalism: Institutional Change in the German Political Economy, Oxford: Oxford University Press.

Streeck, Wolfgang (2010), “E pluribus unum? Varieties and commonalities of capitalism”, MPIfG Discussion Paper 10/12, Cologne: Max Planck Institute for the Study of Societies.

Steinfeld, Edward S. (2010), Playing Our Game: Why China’s Economic Rise Doesn’t Threaten the West, New York: Oxford University Press.

Szelenyi, Ivan (2010), “Capitalism in China? Comparative perspectives”, in Chinese Capitalisms: Historical Emergence and Political Implications, Chu, Y. (ed), Basingstoke:Palgrave Macmillan, p. 199-223.

Tsai, Kellee S. (2002), Back-Alley Banking: Private Entrepreneurs in China, Ithaca, NY: Cornell University Press.

Tsai, Kellee S. (2007), Capitalism without Democracy: The Private Sector in Contemporary China, Ithaca, NY: Cornell University Press.

Unger, Jonathan, and Anita Chan (1996), “Corporatism in China: A developmental state in an East Asian context,” in China After Socialism: In the Footsteps of Eastern Europe or East Asia, McCormick, B. and J. Unger (eds), Armonk, NY: M. E. Sharpe, p. 95-129.

Wang, Yanfei, and Zhiming Xin (2016), “Supply-side reform ‘needs a big push’”, The China Daily, May 17; available at: http://usa.chinadaily.com.cn/epaper/2016-05/17/content_25324899.htm (accessed May 21, 2016).

Weber, Max (1978), Economy and Society, Berkeley, CA: University of California Press.

Wharton School, University of Pennsylvania (2013), “Road to the Chinese dream? Xi Jinping’s Third Plenum reform plan”, December 13; available at: https://knowledge.wharton.upenn.edu/article/road-chinese-dream-xi-jinpings-third-plenum-reform-plan/ (accessed May 29, 2014).

Wong, Sue-lin (2016), “China’s supply-side slogan means different things to different people”, Reuters, March 14; available at: http://www.reuters.com/article/us-china-economy-reform-idUSKCN0WF0ZL (accessed May 21, 2016).

World Bank and Development Research Center of the State Council (2012), China 2030: Building a Modern, Harmonious and Creative High-Income Society, Washington, D.C.: World Bank.

Yao, Kevin, and Meng Meng (2016), “China expects to lay off 1.8 million workers in coal, steel sectors”, Reuters, February 28; available at: http://www.reuters.com/article/us-china-economy-employment-idUSKCN0W205X (accessed May 22, 2016).

Ye, Chenjun, and Nick Marro (2016) “Location. Location. Location. Economic growth all depends on where you are”, China Business Review, May 18; available at: http://www.chinabusinessreview.com/location-location-location-economic-growth-all-depends-on-where-you-are/ (accessed May 22, 2016).

Yu, Rose (2015), “China’s plan to merge sprawling firms risks curbing competition”, The Wall Street Journal, December 9; available at: http://www.wsj.com/articles/chinas-merger-plans-face-doubts-1449654292 (accessed May 22, 2016).

Zhang, Yuzhe (2014) “Gov’t again tries trimming the fat by slashing pay of SOE executives”, Caixin (English), September 14; available at: http://english.caixin.com/2014-09-25/100732978.html (accessed May 22, 2016).

Zweig, David (2002), Internationalizing China: Domestic Interests and Global Linkages, Ithaca, NY: Cornell University Press.

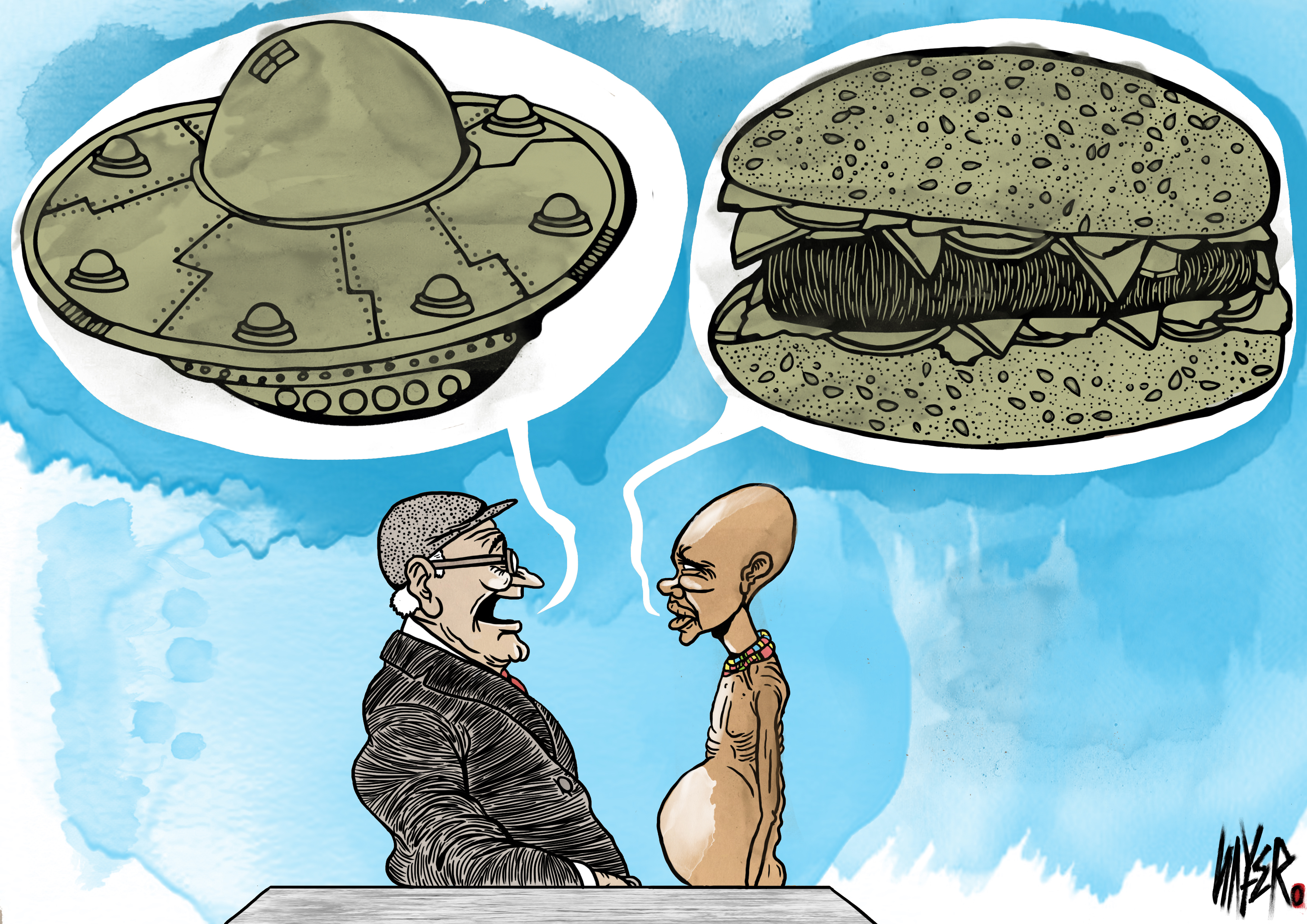

A Spectre is Haunting the West – the Spectre of Authoritarian Capitalism

Amidst the turmoil in global financial markets in recent weeks, something unusual has happened.

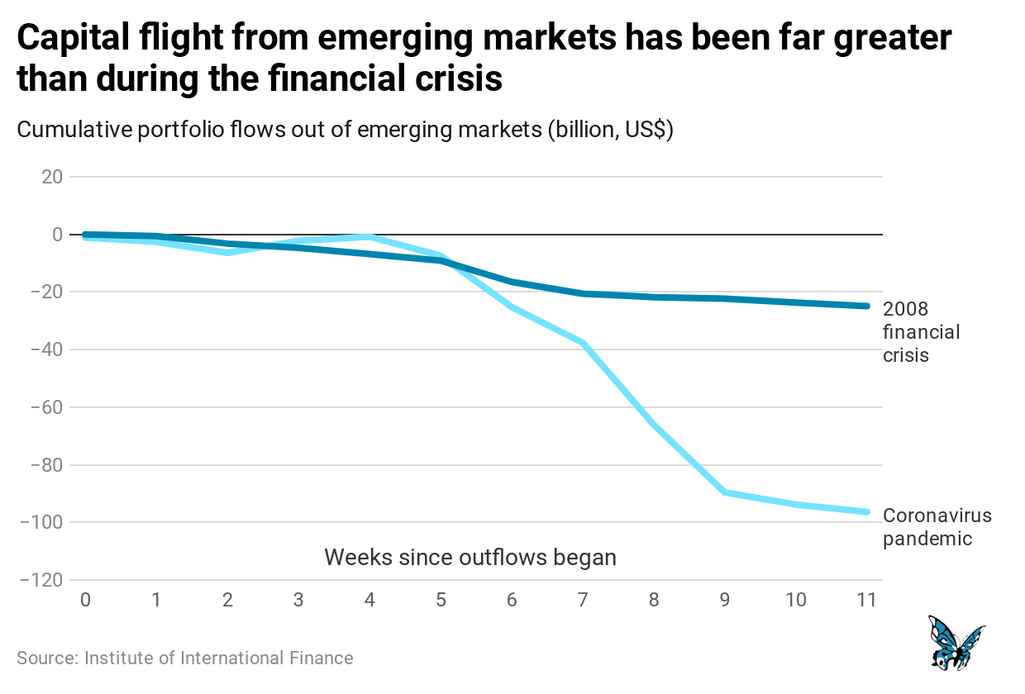

Investors, seeking shelter from the coronavirus-linked sell-off, have piled into Chinese government bonds on an unprecedented scale. These purchases have increased the total foreign ownership of Beijing’s bonds to record highs, even as much of the country is still emerging from lockdown after the viral outbreak. In an ironic twist, the country where the pandemic originated has become an unlikely safe haven for investors – a shift that one prominent trader has described as “the single largest change in capital markets in anybody’s lifetime.”

But it is not only investors that are looking to China. Last month the European Commission president, Ursula von der Leyen, thanked Beijing for delivering more than 2 million masks and 50,000 coronavirus testing kits to European countries including France, Italy, the Netherlands and Poland. Europe is not alone: after successfully bringing the spread of the virus under control domestically (for the time being at least) China has embarked on a high-profile campaign of health diplomacy, winning applause around the world for providing support to countries in need.

Chinese civil society is playing its part too. The Jack Ma Foundation, a charitable organization led by China’s wealthiest individual, has pledged to provide each African nation with 20,000 testing kits, 100,000 masks and 1,000 protective suits.

In the US, things look rather different. President Trump’s mishandling of the crisis has put the US on track to experience the most deadly outbreak of any major country. After initially denying the gravity of the pandemic, President Trump quickly turned his fire on Beijing, referring to the disease as the ‘Chinese virus’. Meanwhile, the President’s allies on both sides of the Atlantic have demanded that China pay reparations for allegedly causing the outbreak.

Despite launching a massive $2 trillion stimulus package to cushion the economic blow from the pandemic, many believe that the US is sleepwalking into a public health catastrophe – one that will be beamed onto TV screens all over the world.

In stark contrast to China’s international charm offensive, President Trump has stayed true to his ‘America First’ philosophy. In March it was reported that Trump had offered international medical companies large sums of money to produce vaccines “only for the United States”. At the beginning of April, 200,000 masks that were produced in Singapore by US firm 3M and bound for Germany were confiscated in Bangkok and diverted to the US, an incident that a senior German official described as “modern piracy”. The government of Barbados has also accused the United States of “seizing” ventilators that were bound for the country and paid for by singer Rihanna. This week, President Trump announced that the US was halting payments to the World Health Organization (WHO) over its handling of the pandemic, a move that has attracted condemnation from leaders around the world.

Signs of diminishing US soft power are not new. Neither is the adoption of a more assertive stance towards China in Washington – it was Barack Obama, not Donald Trump, that initiated the pivot in American strategy towards China in 2011.

But under Trump’s leadership, tensions between the two global powers have escalated, as have Washington’s efforts to contain China’s rise. Now, the acrimony over the coronavirus pandemic has added fuel to the fire.

At the root of these rising tensions lies a common cause: the emergence of an economic model that has the potential to rival the productive power of Western liberal capitalism – and ultimately threaten the technological supremacy that has long underpinned US hegemony.

China’s Economic Miracle

Last year the People’s Republic of China celebrated its 70th anniversary. The occasion marked the victory of Mao Zedong’s forces over the Kuomintang-led government of the Republic of China, securing the Communist Party of China’s control over the world’s most populous nation.

Under Mao’s leadership, the country did experience moderate economic expansion, with real GDP per capita growing at an average of 4% between 1952 to 1978. But life was chaotic and often violent, with grand schemes such as the Great Leap Forward and Cultural Revolution failing to live up to their promise, while also inflicting unnecessary and often brutal suffering on China’s rapidly growing population.

In 1978, Deng Xiaoping became China’s new paramount leader, after outmanoeuvring Mao’s chosen successor, Hua Guofeng. Deng oversaw the country’s historic ‘Reform and Opening-up’ process, which increased the role of market incentives and opened up the Chinese economy to global trade. In the decades since, China’s economic transformation has been nothing short of astonishing.

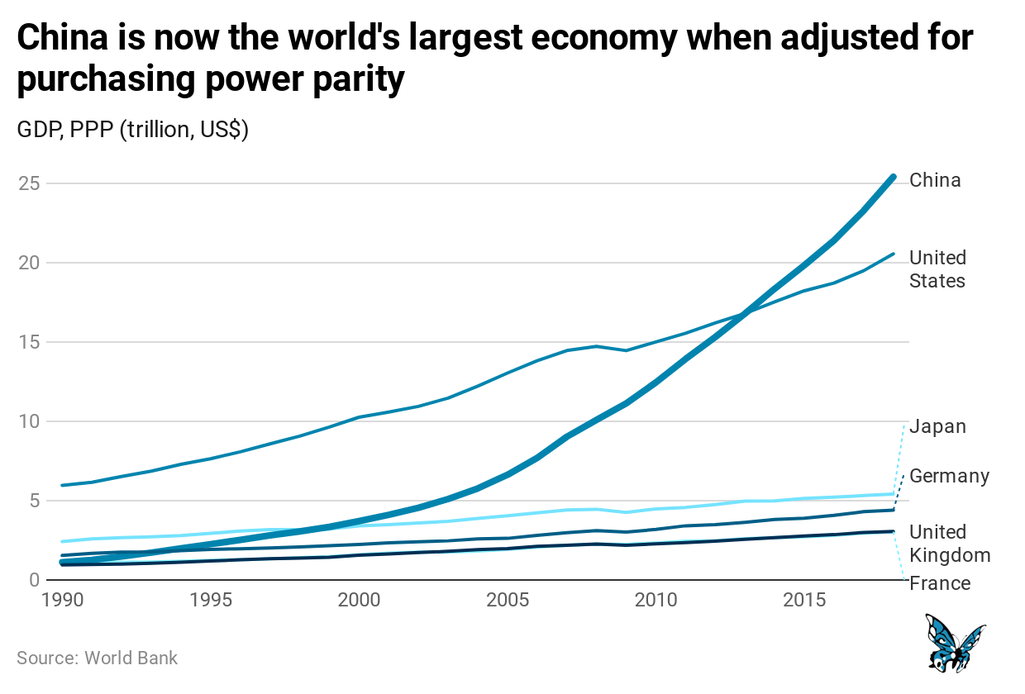

In 1981, 88% of the Chinese population lived in extreme poverty. In the four decades since, nearly a billion people have been lifted out of poverty, leaving the figure at less than 2%. Over the same time period, the size of China’s economy increased from $195 billion – around the same size as the Spanish economy – to nearly $14 trillion today. By some measures, China’s economy has overtaken the US and is now the largest in the world. China is also home to the second largest number of Fortune 500 companies in the world, and more billionaires than Europe.

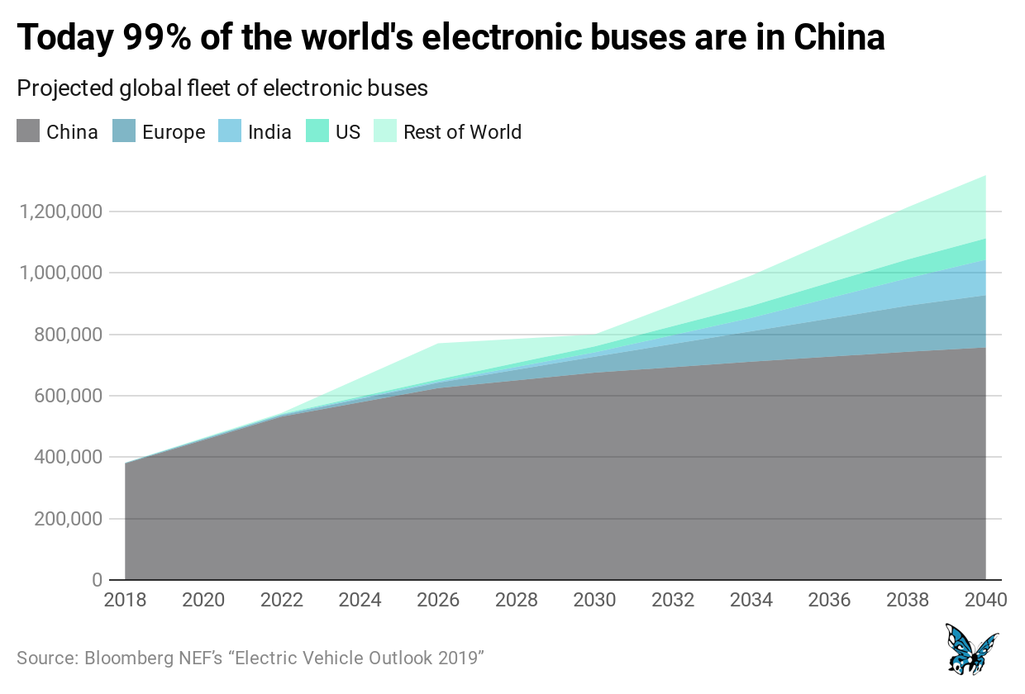

According to the World Bank, China has experienced “the fastest sustained expansion by a major economy in history.” But this has not come without costs, particularly to the environment. Since 2006 China has been the largest emitter of CO2, and today it is the world’s largest consumer of coal, and the second-largest of oil. But unlike the US, China is taking the challenge of environmental breakdown seriously. In recent years, China has spent more on greening its energy system than America and the European Union combined. China is now the world’s leading investor in wind turbines and other renewable energy technologies, and produces more wind turbines and solar panels each year than any other country. Out of the 425,000 electric buses that exist worldwide today, 421,000 are in China – the US accounts for a mere 300.

Under the leadership of Xi Jinping, the Communist Party of China has bold plans for the future. Since taking office in 2012, President Xi has overseen a major crackdown on corruption, and has launched a number of ambitious socio-economic reforms. Foremost among these is the ‘Belt and Road Initiative’ (sometimes referred to as the New Silk Road) to connect Asia with Europe and Africa in one of the grandest and most disruptive mega projects the world has ever seen.

Xi’s ambitions are not limited to planet earth. Under his leadership, the regime has also placed a major emphasis on enhancing China’s space capabilities as part of the nation’s development strategy, referring to this as China’s ‘space dream’. A recent white paper setting out China’s ambitions in space included plans for a lunar presence, asteroid mining and deep space exploration.